Huge Price Slash!

BP Monitors, Glucometers, Thermometers, Nebulizers, and Diagnostic Kits are now taxed at just 5% GST.

GST 2.0 has reduced tax rates on health monitoring devices, such as glucometers and thermometers, from 12% or 18% to 5%. This change lowers costs for hospitals, diagnostic centers, and for patients and regular users at home making these devices more accessible and affordable.

GST 2.0: A Landmark Shift Towards Affordable Healthcare in India

India has taken a decisive step towards making healthcare more accessible, affordable, and future-ready. The recently announced GST rate rationalization, effective from 22 September 2025, has ushered in sweeping changes that will directly benefit households, patients, and the wider healthcare industry. These reforms are designed not only to ease the cost burden on families but also to simplify compliance for businesses, strengthen supply chains, and create a more robust ecosystem for growth in healthcare and allied sectors.

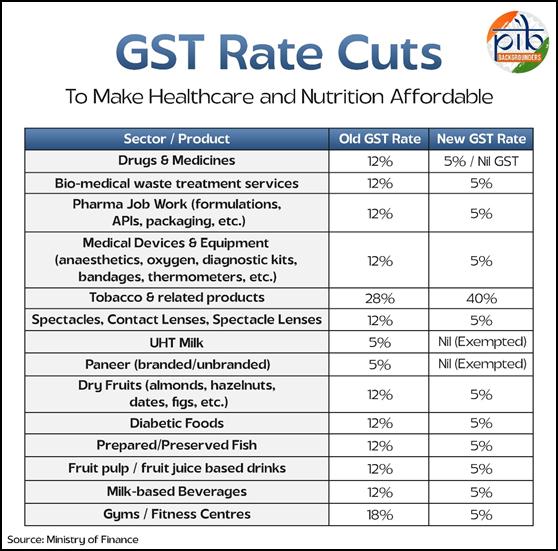

According to the Press Information Bureau (PIB), the GST on essential medical products such as thermometers, glucometers, and diagnostic kits has been reduced to 5%, marking a significant cut from the earlier rates of 12% and 18%. An EY Tax Alert further highlights that medical apparatus, equipment, and diagnostic supplies—including reagents and blood glucose monitoring systems—have all been moved to the lower 5% bracket. The GST Council’s official release confirms these reforms extend to devices used across medical, surgical, dental, and veterinary applications, as well as diagnostic kits and consumables.

This decision represents more than just tax reform—it is a public health milestone. By making healthcare essentials more affordable, India is aligning taxation policy with its broader goal of universal healthcare and improved access for all citizens.

Key Changes in the GST Framework That Reshape Healthcare

The GST restructuring is not a minor tweak. It is a structural shift that influences how Indian households and healthcare providers will spend, save, and manage treatment costs in the years to come.

1. Medical & Diagnostic Devices

Taxes on critical devices such as blood pressure monitors, glucometers, thermometers, pulse oximeters, nebulisers, ECG machines, diagnostic kits, reagents, and even consumables like bandages have been reduced from 12%/18% to 5%. Importantly, revised MRPs must apply even to products already on retail shelves, ensuring immediate relief for consumers.

2. Lifesaving Medicines

Thirty-three essential drugs, including several cancer and chronic disease therapies, have been moved to the zero-GST bracket. Others have been reduced from 12% to 5%. Analysts forecast this will bring down treatment costs by 7–10% on average, offering much-needed financial respite to families managing long-term illnesses.

3. Health Insurance

For the first time, health insurance premiums—including family floater policies and senior citizen plans—are exempt from GST. This reform is expected to accelerate the adoption of health insurance, extending financial protection to millions more households.

4. Other Healthcare Inputs

Tax relief has also been extended to medical oxygen, appliances, and allied diagnostic supplies, easing affordability throughout the healthcare supply chain. Interestingly, sectors beyond healthcare—such as agriculture and medical equipment manufacturing—will also benefit, creating indirect support for India’s health infrastructure.

How This Affects Households: Tangible Benefits for Families

Healthcare costs form a sizeable portion of Indian household budgets. Government data indicates that Indian families spend over ₹120 billion annually on health-related expenses. Rural households spend approximately ₹309 per month on healthcare, while urban households average nearly ₹460, with medicines and diagnostics forming the largest chunk.

With GST reforms in place, here is what families will actually feel:

Affordable Monitoring at Home

Devices like glucometers, blood pressure monitors, and oximeters will now come with lower price tags, encouraging more households to practice preventive healthcare at home.

Greater Adoption of Preventive Tools

Lower costs will remove entry barriers, enabling more families to invest in reliable monitoring tools for early detection and proactive care.

Reduced Treatment Burden

With essential drugs now zero-rated and others taxed at 5%, the expense of managing chronic conditions will reduce significantly.

Savings That Compound Over Time

For families with recurring medical expenses, cumulative yearly savings will free up funds for education, nutrition, or unforeseen emergencies.

Mandatory Compliance on MRPs

Revised regulations will ensure price benefits are passed down to end users, with manufacturers and retailers required to update MRPs in line with new tax structures.

The Wider Impact: Strengthening India’s Healthcare Ecosystem

The GST reforms extend benefits well beyond individual households. They are reshaping India’s healthcare ecosystem in multiple ways:

Encouraging Preventive Care – Affordable devices drive greater adoption of regular health monitoring.

Boosting Industry Growth – Reduced taxation and compliance hurdles encourage innovation and expansion in the medical devices sector.

Bridging the Urban–Rural Divide – Affordable technologies empower healthcare providers and families across rural and semi-urban regions.

Advancing National Health Goals – By lowering barriers to access, the reforms move India closer to its vision of universal, affordable healthcare.

Implementation and Industry Reception

While the new GST rates came into force on 22 September 2025, the GST Council has decided to phase in certain changes to balance fiscal considerations such as the compensation cess fund. The Central Board of Indirect Taxes and Customs (CBIC) has also been tasked with introducing a revised refund mechanism, allowing for 90% provisional refunds under the inverted duty structure through a risk-based model, similar to that used for zero-rated supplies.

The healthcare industry has widely welcomed these reforms. Industry leaders note that exempting lifesaving and cancer medicines from GST will provide direct relief to patients and families. Similarly, lowering GST on a broad range of therapies and devices ensures wider access to essential healthcare and supports the government’s long-term vision of “Healthcare for All.”

Looking Ahead

The GST restructuring is more than just a fiscal adjustment; it represents social reform through economic policy. By lowering the cost of essential devices, medicines, and insurance, India is ensuring healthcare is no longer a privilege for the few but an everyday reality for all.

This moment presents a unique opportunity for the healthcare industry, policymakers, and brands to collaborate in delivering affordable and preventive care solutions at scale. The ripple effects—healthier citizens, reduced medical debt, and a stronger economy—will be felt across the nation.

A Note to Our Customers

At Dr Trust, we see this reform as a chance to reach even more households with reliable, excellent health monitoring solutions. With prices now aligned to the new GST regime, our extensive portfolio—including BP monitors, glucometers, oximeters, nebulizers, and thermometers—is more affordable than ever.

We invite you to check our current product list with reduced prices, explore devices that can empower your family’s preventive healthcare journey, and share your views on how these reforms are shaping your household’s healthcare choices. Together, as part of the Dr Trust community, we can make healthcare smarter, preventive, and truly accessible.